M&As: Disney & Hulu the latest, huge industry tie-up

Disney has gained full control of Hulu, the SVOD service.

This latest move could result in huge shifts in the industry. Put simply, it’s big news.

In a complicated agreement with Comcast, who had been – and remain – the only other shareholder through its acquisition of NBCUniversal which was completed in March 2013, Disney takes “full operational control”.

What makes the deal complicated?

Here’s an excerpt from the official announcement:

In plain English, that means that within five years, Comcast can require Disney to buy out its 33% share of Hulu for a minimum price of $5.8 billion – which could rise following the assessment of Hulu’s fair market value by an independent body – but Disney can also compel Comcast to sell for its fair market value on that same timeframe.

The potential payout is based on Hulu’s current $27.5 billion valuation, which is likely to be based on that of Netflix and the like, and could rise or fall.

It’s always been complicated…

Hulu had been a joint-venture between News Corporation, NBCUniversal, US private equity firm Providence Equity Partners and, from 2009, Disney.

The online service showed programming that was still being broadcast on linear channels owned by those involved in the enterprise.

Hulu Plus, a subscription service, was launched in 2010, and Hulu with Live TV, an over-the-top IPTV service, arrived in 2017, with Time Warner holding a stake.

Ownership of Hulu then looked like this:

- NBCUniversal 30%

- 21st Century Fox 30%

- Disney 30%

- Time Warner 10%

In March 2019, Disney acquired Fox, giving it a 60% majority stake (the first time in Hulu’s history that a single company had owned a majority stake in the business); AT&T bought Time Warner and sold back its 10% stake; and Comcast acquired NBCU, giving it a 33% stake in Hulu.

Why’s this big news?

Firstly, it makes an interesting play against Netflix. Disney is expected to expand Hulu internationally.

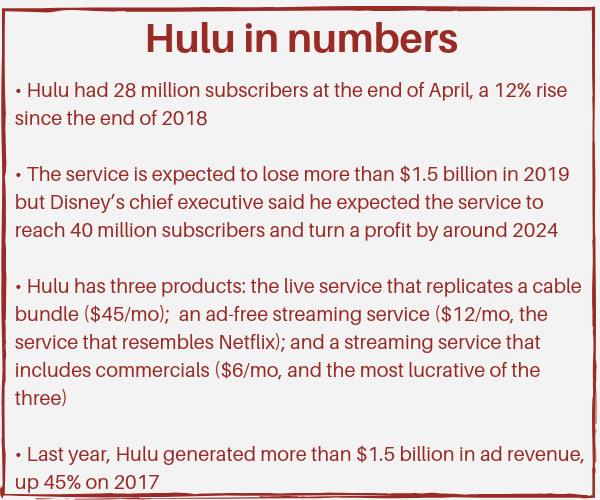

Netflix has 148 million subscribers globally, and remains the leading streaming service, and its 60 million US customers more than double the number who pay for Hulu.

But Hulu is growing faster than Netflix in the US.

Also, Disney could use Hulu as the foundation for its upcoming streaming service, Disney+.

Or Disney could retain Hulu’s identity and use it as a home for content (old Fox films, for example) that it deems unsuitable for the Disney brand, for whatever reason.

What it means for Comcast/NBCUniversal

Four months ago, Comcast’s NBCUniversal announced plans to launch a streaming service in 2020. That service would be ad-supported and free, they said, to anyone who subscribes to a traditional pay-TV service, and cost about $12 per month for those who don’t subscribe to pay-TV.

However, following Disney’s announcement that Disney+ will cost $6.99 per month, NBCUniversal has reconsidered its pricing.

NBCU content on Hulu will be available on the NBCU platform, while Hulu will continue to offer its library of licensed NBCU content – to 2024.

Then what? Will NBCU pull its content from Hulu, making it exclusive to its own platform?

What does this mean for the industry and consumers?

Will people start to think more about how many streaming subscriptions they’re willing to pay for? Cutting the cord might save cash but subscribing to Amazon, Netflix, Hulu, Disney et al would soon add up.

Also, if Disney were to push Hulu globally, new agreements would be needed for content rights. Comcast would be among those content owners having acquired Sky last year.

Finally, Hulu enables targeted advertising – and is successful in its delivery. Hulu’s CEO Randy Freer expects the online TV ad market to grow to $50 billion in the next three years.

It’s a story that’s definitely worth watching.

Sources:

Netflix, Paramount and Warner Bros.: What the Deal Means for the Broadcast and Production Industry

How the Employment Rights Act 2025 Is Reshaping the Freelance Market