IR35: April ’19 update

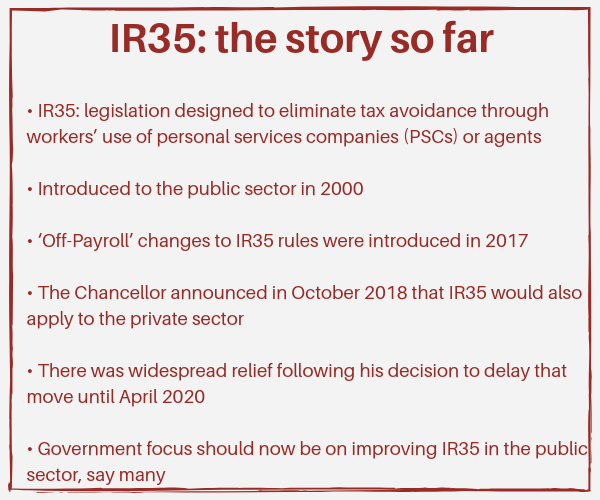

As you might have read on these pages back in January, IR35 – the legislation that’s designed to tax ‘disguised employees’ who work through their own company for tax benefits – has undergone some changes recently, primarily the Chancellor’s announcement in the 2018 Budget that the rules were to be extended to the private sector.

The expansion, however, was to be delayed until 2020.

The government aims to close loopholes that allow people working through personal service companies to avoid tax contributions, and says such avoidance will cost £1.3 billion by 2023-24.

Here’s how we summed up the story three months ago:

This has been a hot topic ever since the government shifted responsibility, in 2017, for IR35 determination from the contractor to the business that hired them.

The broadcast industry has been at the forefront of the resulting implications, given its heavy reliance on freelancers.

A second consultation on the implementation of IR35 in the private sector was opened last month, with comments closing towards the end of May 2019.

How are contractors affected by IR35 changes?

Contractors who fall within IR35 rules must pay income tax and National Insurance contributions (NICs) as if they were permanent members of staff rather than working as freelancers managing their own tax position.

However, those contractors do not get the same benefits as employees they might be working alongside, such as holiday pay, pension entitlement, sick pay or maternity leave.

Some estimates suggest that freelancers’ net income can be reduced by a quarter as they must pay more in taxes and NICs.

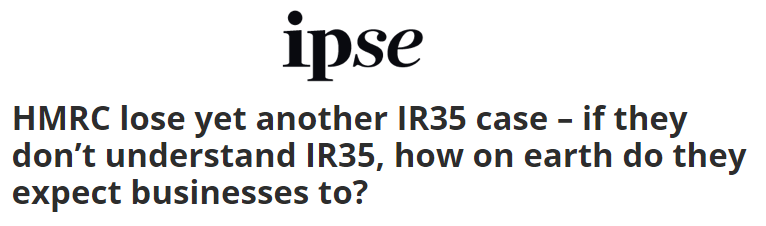

It’s not going well for HMRC: high-profile IR35 cases

There have been some high-profile cases recently, one involving the Scottish presenter Lorraine Kelly, which hit the headlines.

Kelly recently won an IR35 hearing after she successfully challenged a demand for £1.2 million in tax and NICs. A tribunal ruled that she was not an ITV employee and therefore did not owe the Treasury any money.

HMRC had concluded that there’d been a direct contract between Kelly – who’d described herself in the proceedings as a “self-employed star” – and the broadcaster.

But the tribunal deemed Kelly’s work for other employers, including a magazine and other broadcasters, made her a contractor rather than an employee, and, therefore, placed her outside IR35 rules.

This was the fourth of five IR35 cases that HMRC has lost since the beginning of 2018.

Another involved presenter and journalist Kaye Adams, who successfully appealed a £124,000 tax bill.

Bizarrely, there was also a case that was stopped before it could even get going, as HMRC’s own charter for taxpayers was used against it.

Here’s how IPSE sees it:

Anger is growing…

IR35 legislation has been criticised for being confusing, hard to implement effectively and the reason why people are leaving contracting jobs in the public sector (for example, TfL blamed IR35 changes for the delay of a London Underground repair programme).

And while HMRC has promised to maintain its work on its CEST tool, which is used to check a person’s employment status, it’s often been described as not fit for purpose.

…and even MPs are warning HMRC

Furthermore, the government has been accused of not understanding its own IR35 reforms – by MPs, who have warned that the failure to learn the lessons of the public-sector rollout will mean that people won’t seek guidance from HMRC, and both contractors and the economy could suffer.

What does this legislation mean for the freelancer?

It means, clearly, that you need to protect yourself.

The importance for contractors to hold appropriate insurance policies is crucial – professional indemnity, and public and employers’ liability are recommended.

While the government has said that the UK’s smallest contractor companies – about 1.5 million – won’t be included when IR35 legislation is extended to the private sector in 2020, it doesn’t mean that they won’t need to be aware of the reforms and, potentially, guard against them.

How are companies dealing with IR35?

Many companies are preparing for the changes to follow the pattern seen within the public sector. This could see high-profile contractors with specialist skills potentially moving to projects with smaller companies who are operating outside of the change in legislation.

In order to protect key projects, some companies are looking to increase day rates to compensate, some are making contingency plans and looking at engaging a more junior workforce that will be engaged within IR35 and added to a third party supplier’s payroll.

How will companies work with IR35 in the future?

We predict that there will be an increase in Statement of Work (SOW) engagements whereby a client is contracting a supplier to deliver an outcome. Many companies shall increase their contractor rates to reduce the risk of losing key contractors to smaller competitors.

Due to questions around the accuracy of the CEST tool, it is likely companies will take a blanket approach, with many assignments being deemed inside IR35 to mitigate risk.

From Frame 25

This post will not be last we write on the subject of IR35. The best way to keep up to date with what’s going on is to sign up to our mailing list – that way, you’ll get an email every time we publish a new post on this blog, including those concerning IR35.

Netflix, Paramount and Warner Bros.: What the Deal Means for the Broadcast and Production Industry

How the Employment Rights Act 2025 Is Reshaping the Freelance Market