Product + audience + platform: why the Premier League is going its own way

- The Premier League and IMG are to split after 20 years of Premier League Productions

- The Premier League is the most-watched league in the world, reaching 920 million homes in 189 countries

- Premier League football is among the country’s most valuable products and biggest exports

- Many believe the move will usher in a direct-to-consumer (DTC) model

- Is the Premier League moving closer to becoming “the Netflix of football”?

Premier League and IMG: approaching full-time

For the past 20 years, international audiences have watched Premier League matches via only one production company, which provides coverage, graphics and analysis to territories and broadcasters with or without their own presentation.

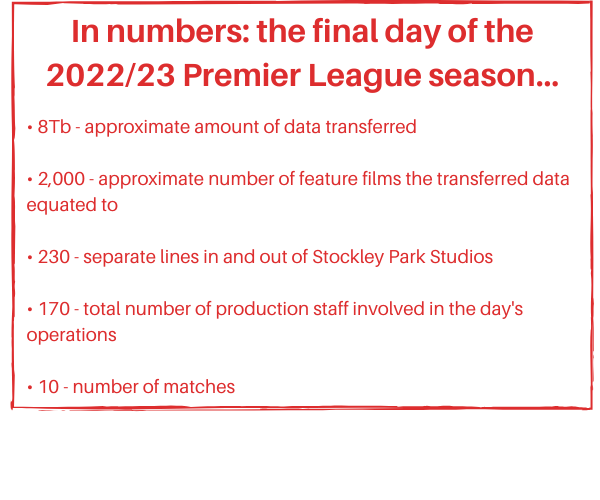

Premier League Productions (PLP), operated by IMG from their Stockley Park Studios, close to both the Video Assistant Referees (VAR) base and Heathrow airport, produce the feeds watched by audiences all over the world – and in the sky, since PLP also serves airlines’ inflight entertainment packages.

At present, PLP uses underground fibreoptic cables which run between its base and every Premier League stadium to transmit information at 200,000km per second, enabling 380 matches per season to be broadcast within the UK and globally almost instantaneously.

PLP delivers 6,000 hours of content per season to 55 international broadcast partners covering 189 global markets, along with long-form content such as magazine shows.

Every Premier League game since 1992, and the accompanying interviews and behind-the-scenes footage, is stored within PLP’s cloud storage.

Striking out

The Premier League is to establish a new in-house media operations business, ending the competition’s 20-year partnership with IMG.

The 20 top-flight clubs unanimously agreed at a recent Premier League shareholders’ meeting to the creation of a new enterprise which will bring all international media content production and distribution in-house.

The Premier League and IMG have, since 2004, created, produced and sold content together but, from the start of the 2026/27 season, this significant move shifts the Premier League closer to a direct-to-consumer (DTC) model.

The most-watched league in the world already reaches 920 million homes. How might this move bring it even greater riches?

The world’s most valuable sport

Global sports media rights stand at $62.61bn, surpassing $60bn for the first time, according to the SportBusiness Global Media Report.

Football and American football generate 54.5% of the overall value, which is up 12% on last year’s figure of $55.85bn, while the Paris 2024 Olympics, and this year's men's European Championship, are believed to have significantly boosted the growth.

And while cricket and US college sports also contribute to the value of global sports media rights, football contributes more than a third of revenues, and is the world’s most valuable sport.

The domestic picture: not as bright

A deal in 2022 meant that overseas rights (worth £5.3bn) became more valuable than domestic ones (£5bn). The deal represented a 30% increase on the previous arrangement.

Those funds are shared among the league’s clubs, which is how they’re able to attract the world’s best players and managers.

The latest agreement to broadcast Premier League football in the UK, however, is not as lucrative as it once was.

The latest domestic deal runs from 2025/26 to 2028/29 and is worth about £6.7bn. The annual figure of that contract works out at £1.675bn. The corresponding figure for the 2016 to 2019 seasons, in a deal stuck in struck in 2015, was £1.713bn.

How long has the Premier League’s move been on the cards?

In an article on img.com last summer, Barney Francis, IMG’s executive vice-president and head of global production, was asked whether the company might go direct to international consumers, thereby cutting out the broadcasters in those countries.

“For anybody in your own domestic market, you need an underpinning of revenue up front – the clubs need to know how much money they’re going to get so they know how to scale their ambitions, know their investment plan, wage structure and all those things,” he said.

“For the past 30-odd years, that money has been fronted up by Sky, BT, Setanta, ESPN, Amazon, but that doesn’t mean a private equity firm [or] venture capitalist firm couldn’t do that and back a plan direct to the consumer. But it’s still fraught with all sorts of possibilities.”

However, speaking the previous year at APOS, the Asian event for the media, telecoms and entertainment industry, the Premier League appeared to position itself for a D2C move when Richard Masters, the league’s chief executive, said there were “narrow opportunities in Asia to go D2C if we choose to do so”.

Apple and MLS set a precedent

In June 2022, Apple announced a new 10-year partnership with Major League Soccer (MLS). Apple now shows more than 1,000 matches per year. Some games are available free via the Apple TV app, others stream only to Apple TV+ subscribers, and the rest are shown via a MLS streaming service exclusive to the Apple TV app.

In 2023, IMG was chosen as the production partner alongside NEP for to produce this content.

Former Crystal Palace chairman has his say

UK-based fans of Premier League football pay more, according to former Crystal Palace chairman Simon Jordan:

“It is affordable – for everybody else around the world – to watch the content of Premier League football, because it’s vastly different economics that are buying those media rights.

“Where it isn’t affordable is in this country, and the irony of it is, is that you can watch Premier League football in North America or Australasia for a fraction of the price that you can watch it here for, because the broadcast deals that are being bought for overseas deals are a fraction of the cost of what the broadcasters are paying in this country.

“They’re visiting that on the consumer because of the cost implications of it. Whereas, if you’re in North America and you’re paying 300 million for a broadcast deal, whoever’s carrying it, which (is) NBC I believe, then ultimately the cost implications of it for the American consumer, sitting in America watching Premier League football, is far cheaper.”

How much does it cost to watch the Premier League?

Sky subscribers need to be a Sky TV customer and then add Sky Sports Premier League for £20 a month.

TNT Sports costs £20 a month when purchased with a broadband package.

In the US, NBCUniversal’s streaming service Peacock streams 175 Premier League games per season and costs $7.99 (about £6.27) per month.

Is a Premier League move to DTC feasible?

Netflix had around 282.7 million paid subscribers worldwide as of the third quarter of 2024.

Jordan suggests a customer base of 100,000,000 Premier League subscribers, each paying £10 or the equivalent every month, “is not beyond the wit of man”.

“That’s a billion pounds a month,” he says.

“You’re talking about 12 billion pounds a year. And (that’s) before you get advertising in there. It probably could be 20 billion a year. So over a four year cycle, you’ve got an 80 billion revenue stream against a 12 billion revenue stream right now.

“But then you’ve got the cost implications of it in terms of indigenous talent being able to present and show shows around the world, because obviously you’ve got to be able to translate it. I don’t think it’s beyond the wit of man to do it, and I think, certainly economically, it’s viable.”

Churn: when customers cancel...

“The biggest challenge to broadcasting right now is churn,” says Jordan.

...where do they go?

Some subscribers cancel and choose another streaming service. Others stop subscribing altogether. Another group opts for illegal streams.

Piracy

Would easier and more affordable access to Premier League football reduce piracy?

This sounds like simple supply-and-demand economics: while the demand is clearly there the supply to consumers is currently expensive and fragmented in that it’s difficult to follow one team or to subscribe to one service and watch multiple teams.

Will the 3pm Saturday blackout survive?

Another way the Premier League could tackle domestic piracy is by scrapping the Saturday 3pm blackout.

The use of illegal live streams of Premier League matches has surged in recent years and this piracy could lead to a reduction in the value of domestic broadcast rights.

One simple solution could be the Premier League deciding to open up UK broadcasting opportunities during the Saturday 3pm blackout.

The blackout rule, which was introduced in 1960, is approved by European football’s governing body, UEFA, aimed at protecting attendance figures, and follows an application from the FA, the Premier League and English Football League (EFL).

The UK is the only country in Europe where it’s implemented and many see it as outdated.

The EFL reportedly considered abandoning it in its latest broadcast deal.

Under the terms of the rule, 50% of matches in the top flight and Championship must be scheduled to kick off at 3pm on a Saturday.

But with season tickets becoming difficult to afford or justify amid rising household bills, a shrinking UK economy and the cost of broadcasters’ and streaming subscriptions, football fans often find cheaper ways to watch their teams.

The blackout is another factor why many supporters watch illegal live streams, often buying unauthorised services via Amazon Firesticks to do so.

A popular move

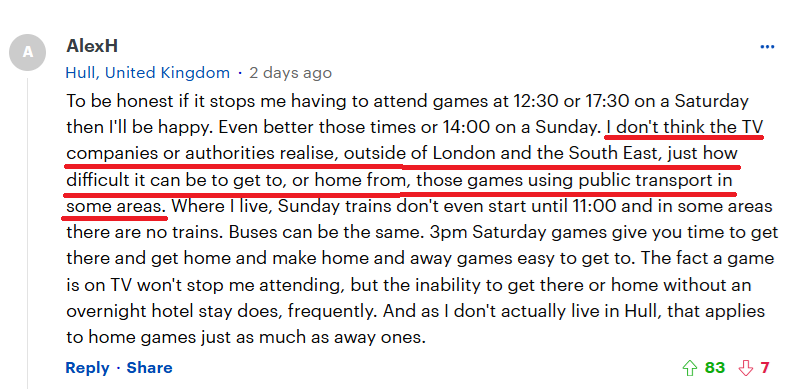

Scrapping it could prove popular among those fans who regularly attend games. Supporters of the perhaps ‘less glamorous’ football clubs – among them those with a smaller following globally – often say broadcasters and streaming companies are less likely to transmit their teams’ matches. Ohers, meanwhile, say kick-off times which are moved for broadcast purposes make it difficult for many fans to get to games.

What does this mean for IMG?

Losing the Premier League’s business is clearly far from ideal, especially at it follows news earlier this year that IMG Media’s production arm was laying off around 5% of its staff.

But IMG still has other major clients on long contracts.

“With IMG’s wider production work for rightsholders such as the EFL, MLS and Apple, the Saudi Pro League, EuroLeague and ETP, we are continuing to power live sports broadcasting,” Francis said.

Netflix, Paramount and Warner Bros.: What the Deal Means for the Broadcast and Production Industry

How the Employment Rights Act 2025 Is Reshaping the Freelance Market