Key changes to IR35 coming in 2017 – what you need to know

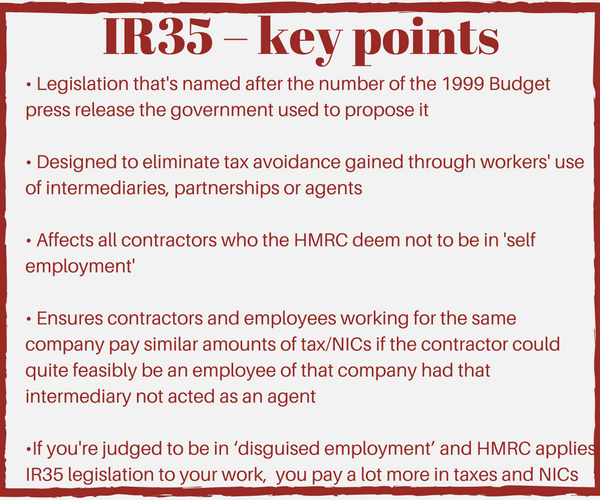

A couple of years ago we published a post explaining what IR35 was all about. Here are some of the key points:

A lot’s been happening – the IR35 back story

IR35 legislation is a huge topic for recruitment companies, contractors and the clients/end users who pay for the services of those contractors.

It’s a fact of life: people generally want to pay as little in taxes as possible.

That goes for individuals as well as those looking after their employer’s interests. Tax efficient methods were found for both parties that meant many people working as contractors would use an umbrella company or set up and work through a limited company – sometimes referred to a ‘personal service company’ or PSC – in order to pay less tax.

Their clients, meanwhile, were happy with the arrangement as it meant they could avoid paying employer’s National Insurance Contributions (NICs).

Everyone was happy.

Apart from the taxman, that is. Hence…

IR35’s introduction in 2000

It was brought in to ensure contractors and employees are playing by the same rules, paying the roughly the same amount of tax, working under the same conditions and enjoying similar benefits.

New government thinking will result in huge change for public sector organisations and many of those who work for them.

IR35 – abused for years

In 2012, Ed Lester, the then chief executive of Student Loans Company, was able to avoid paying £40,000 a year in tax through the use of his own company in a deal signed off by David Willetts, the Universities minister, who said in a letter that it had been “agreed by the Chief Secretary to the Treasury” Danny Alexander.

And in July 2016, In July, the BBC announced that it had changed the professional status of 85 presenters, making them employees, after coming under pressure for allowing those broadcasters to use personal service companies to minimise their tax bills.

The Public Accounts Committee, led by Margaret Hodge MP, described the use of limited companies by public sector contractors and freelancers as “staggeringly inappropriate”.

In October, it was announced that more than 100 BBC staff were to face investigation by HMRC for alleged tax avoidance after being suspected of wrongly using personal service companies to minimise their tax bills.

The HMRC tribunal, to determine whether those workers were self-employed or employed, and should pay tax accordingly, relates to accounting between 2006 and early 2013.

The Telegraph: “Stars such as Jeremy Paxman and Fiona Bruce have previously been paid via their own service companies, although there is no suggestion that they are suspected of any wrongdoing.”

The BBC failed in an application to give evidence in the case. It stated:

The Day IR35 Went Missing

In his first Autumn Statement in November, Philip Hammond failed to mention ‘IR35’ at all. We searched the entire document. ‘IR35’ was nowhere to be seen:

But what he did say was that…

So, workers will no longer be responsible for determining whether they’re a disguised employee or genuinely self-employed, as that task falls upon shoulders of the end client.

How IR35 will work

It essentially means that someone working inside IR35 will become an employee of the party that pays their PSC for tax purposes only. But they won’t benefit from any employment or statutory rights and will continue operating through their own limited company.

Another government IT calamity heading our way?

An online tool that HMRC is to provide for intermediaries, agencies and public sector organisations with which to make their assessments might not be ready in time, which has attracted further criticism.

Chris James, a chartered accountant, says many affected workers won’t be able to get paid in accordance with the proposals in April 2017.

Mr James told IPSE, the Association of Independent Professionals and the Self Employed, of which Frame 25 is a member:

That’s the public sector covered, but the thinking is the government will roll out that legislation to the private sector which potentially has a huge impact, resulting in all PSC contractors caught by IR35, because HMRC “still struggles to police the many personal service companies in existence”.

HMRC believes IR35 “will make the engager responsible for paying and accounting for the taxes rather than just checking they have been paid”.

Why IR35 matters

According to ComputerWeekly.com, about 40% of the UK’s technology workers are contractors.

If you’re among them, and you’re caught by IR35, you might have to pay a lot more in tax, interest and penalties, and be subject to a lengthy HMRC investigation.

So, under the rigorous IR35 rules, are you an independent contractor or actually an employee of your client?

It pays to know your IR35 status.

Here’s a helpful list of determining factors, and here’s a good, free online IR35 test that offers a quick way to confirm your IR35 status.

Netflix, Paramount and Warner Bros.: What the Deal Means for the Broadcast and Production Industry

How the Employment Rights Act 2025 Is Reshaping the Freelance Market