COVID-19, the broadcast industry and how freelancers can protect themselves

Global news headlines make for pretty dark reading at the best of times but the outbreak of Covid-19 has taken things to a whole new level.

While front pages and news websites are dominated by the spread of coronavirus, most industries can tell their own horror stories.

Looking beyond the headlines, it’s painfully easy to understand the deeper, serious effects that the Covid-19 outbreak is having on the broadcast industry.

Many contractors have seen months of promised work wiped out.

Philippa Childs, head of Bectu, told Variety:

The UK’s Media Production and Technology Show, due to take place 13-14 May 2020 at London Olympia, has been postponed, and NAB – the world’s largest gathering of technology, media and entertainment professionals – has been cancelled, having been scheduled to take place in Las Vegas next month.

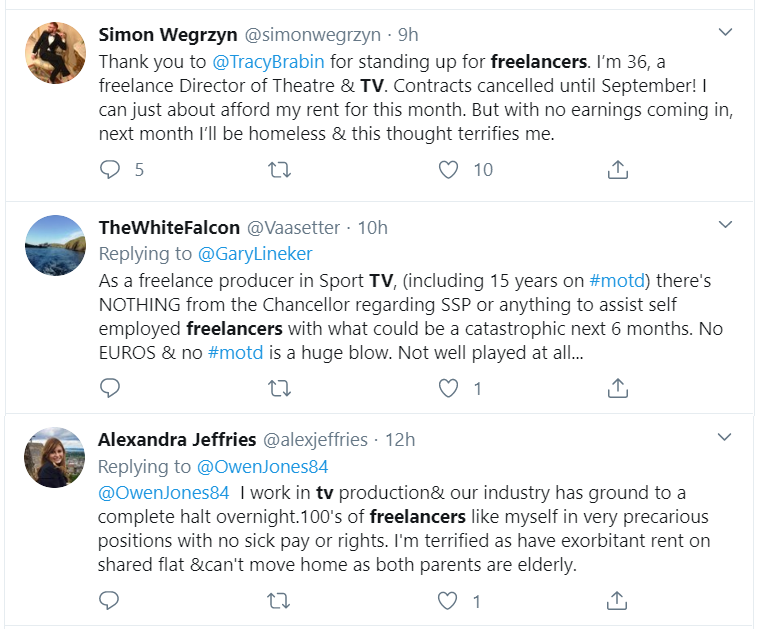

So what effect is this having on broadcast freelancers and the industry?

Mental health and wellbeing

With high-profile sports events all over the world cancelled or postponed, and all manner of other productions suspended, these are particularly tough times.

Without work and the prospect of no income for the weeks or even months ahead, levels of stress and anxiety among broadcast freelancers will inevitably rise.

As people all over the world are told by their governments to stay home, and many fill their time by watching TV, what about the very people who made that content, those shows and commercials?

That Bectu survey

In the UK, a recent survey of more than 5,600 creative freelancers by Bectu found that 97 per cent think the government is failing to respond to their concerns during the coronavirus crisis.

Philippa Childs said:

What is the government doing to help broadcast freelancers?

IR35: suspended until April 2021

Whether it’s to help freelance contractors or simply because demands caused by the Covid-19 outbreak mean the UK government doesn’t have the necessary resources, the IR35 tax reforms have been deferred until April 2021.

The off-payroll working rules – to give IR35 its official title – were due to be extended into the private sector next month but the chief secretary to the Treasury, Steve Barclay, announced the decision on 17 March.

The prospect had been causing stress for many in our industry well before most of us had even heard of coronavirus.

Government assistance for the self-employed: what help is available?

While the UK producers’ body, Pact, has called for government support for the industry, some assistance is available already:

- A new HMRC helpline has been launched to help businesses and the self-employed concerned about paying tax due to Coronavirus (COVID-19).

HMRC says up to 2,000 experienced call handlers are available to support businesses and individuals.

The helpline number is 0800 0159 559. Opening hours are Monday to Friday 8am to 8pm, and Saturday 8am to 4pm. The helpline will not be available on Bank Holidays.

- Employment and support allowance, and universal credit

If you're not claiming any benefits you might be entitled to claim employment and support allowance (ESA) or universal credit to top up your income. Universal credit is a monthly payment to help with your living costs. You may be able to get it if you’re on a low income or out of work.

The Self-employment and Universal Credit page is here.

More information here, including on statutory sick pay.

Additional resources:

- The Creative Industries Federation has provided a two-page PDF, linking to resources or groups dedicated to assisting creatives, freelancers and businesses through the pandemic.

- Coronavirus Financial Help & Rights – MoneySavingExpert.com

- COVID-19 Industry Support: Film, TV and Advertising – Facebook group

- Do you use Adobe Creative Cloud?

TOP TIP for Creatives... If you use Adobe and you're worried about keeping up payments, you can go to cancel your Creative Cloud plan, select 'Too expensive' as a reason for cancelling and you'll be offered 2 months for £0. Every little helps and all that, so thought I'd share.

— Elliot Gonzalez (@elliot_gonzalez) March 17, 2020

How the Employment Rights Act 2025 Is Reshaping the Freelance Market

Umbrella Company Reforms - An Overview